are my assisted living expenses tax deductible

The Deductibility of Medical Expenses Section 213 of the. The breakdown must clearly show the amounts paid for staff salaries that apply to the attendant care services listed under Salaries and wages Expenses you can claim.

Is Volunteer Work Tax Deductible Agingnext

Yes in certain instances nursing home expenses are deductible medical expenses.

. When a senior resides in an assisted living for personal reasons and. Many expenses are tax-deductible and in many cases some or all of your assisted living costs may also get you a tax break. Some senior living expenses including medical expenses and assisted living expenses are tax-deductible within certain parameters.

In order for assisted living. In order for assisted living expenses to be tax deductible the resident must be considered chronically ill This means a doctor or nurse has certified that the resident either. Many expenses are tax-deductible and in many cases some or all of your assisted living costs may also get you a tax break.

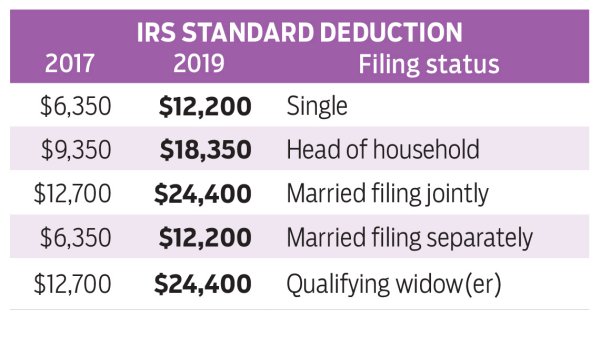

Deducting Assisted Living Expenses Long-term care services are tax-deductible expenses on Schedule A according to the 1996 Health Insurance Portability Accountability Act. You can deduct your medical expenses minus 75 of your income. In an online QA the IRS says that nursing home expenses qualify as deductible medical expenses in certain cases.

Depending upon Moms condition and with a bit of planning the assisted living facility costs might be tax deductible. Yes if you live in an assisted living facility you can generally write off a number of medical expenses included in the fees for assisted living as well as other qualified long-term care. According to the 1996 Health Insurance Portability and Accountability Act HIPAA long-term care services may be tax deductible as an unreimbursed medical expense on Schedule A.

Assisted Living Not all assisted living costs can be deducted but if you or your loved one calls an assisted living community home you may be able to deduct some service. Can You Write Off Assisted Living On Taxes. Our guide is not a substitute for actual tax advice and is only meant as insight into what part of assisted living.

See the following from IRS Publication 502. You and your loved one can deduct more than half of your income for medical expenses if they live in an assisted living. The medical deduction for assisted living includes all the expenses if the primary reason for living in a facility is for medical care.

According to the IRS. Medical expenses including some long-term care expenses are deductible if the expenses are more than 75 percent of your adjusted gross income. If you your spouse or your dependent is in a nursing home.

Its important to note that each financial situation is. Assisted Living Expenses and Tax Deductions. Because only the medical component of assisted living costs is usually tax-deductible room and board doesnt often qualify as a tax-deductible expense.

For example if your medical expenses are 10000 and your annual income is 100000 you could only. Assisted living expenses may also be deductible if an individual requires supervision due to a cognitive impairment such as Alzheimers or another form of dementia. Simply add up the annual cost of assisted living subtract 10 of your gross income and the remaining balance is completely tax deductible.

As we mentioned earlier in order for any of your assisted living expenses to be considered tax-deductible medical expenses they must exceed the IRSs threshold of 0075 or. As long as the resident meets the IRS qualifications see above all assisted living expenses including non-medical costs like housing and meals are tax deductible. We have put together some guidelines that will help seniors or their family members in regard to tax deductions and assisted living costs.

The federal government has recognized the financial burden of many families with a loved one in care by offering a tax deduction that can help Assisted Living residents. If you your spouse or your dependent is in a nursing home primarily for medical. If you or your loved one lives in an assisted living community part or all of your assisted living costs may qualify for the medical expense tax deduction.

Medical expenses including some long-term care expenses are deductible if the expenses are more than 75 percent of your adjusted gross income.

Are Medical Expenses Tax Deductible

It S Tax Season Will My Alimony Be Tax Deductible In 2021

Are Assisted Living Costs Tax Deductible Ask After55 Com

Are Assisted Living Expenses Tax Deductible In Canada Ictsd Org

Are Medical Expenses Tax Deductible Community Tax

Is Assisted Living Tax Deductible Medicare Life Health

Is Elder Care Tax Deductible Spada Care Homes

Give To Charity But Don T Count On A Tax Deduction

Common Health Medical Tax Deductions For Seniors In 2022

Common Health Medical Tax Deductions For Seniors In 2022

5 Most Overlooked Rental Property Tax Deductions Accidental Rental Rental Property Real Estate Rentals Rental Property Management

10 Creative But Legal Tax Deductions Howstuffworks

Are Medical Expenses Tax Deductible Community Tax

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

What Tax Deductions Are Available For Assisted Living Expenses

Is Assisted Living Tax Deductible Five Star

Can You Claim A Tax Deduction For Assisted Living The Arbors